This article originally appeared in the Business Intelligence Digest, June 2018 which is available to view online here

We examine specific trends driving broadcast and media technology spending in Asia-Pacific. The trends we discuss are:

- Transition to Digital Broadcasting

- Transition to HD

- Transition to New Viewing Experience

- OTT and Multi-Platform Delivery

Transition to Digital Broadcasting

The transition to digital broadcasting is alarmingly low with only five countries – Australia, Japan, Korea Rep., Mongolia and New Zealand – having completed the transition. Chart 15 above shows the status of the transition to DTT in the region. It is anticipated that by the year 2020, a number of other countries in the region will have completed the transition to digital broadcasting, including Indonesia, Thailand and Vietnam.

The digital switchover is a challenging, lengthy process that requires proper planning and sufficient resources. The APAC region as a whole is at a similar stage to Latin America and the Middle East and Africa. Beyond this, countries in the APAC region are at different points in the transition, which can cause delays for the countries that have completed it – they are unable to easily re-allocate digital frequencies for mobile use while neighboring countries still use these for broadcasting.

Often emphasized is the essential coordination required between different parties during the process (government, broadcasters, suppliers, customers) to ensure the smooth transition between analog switch-off and digital switchover, whilst maintaining efficiency and minimizing disruption issues.

However, close coordination can be difficult as each country deals with its own individual challenges, which means meeting tight deadlines can be challenging. The lack of DTT progress can hinder the ability of traditional broadcasters, especially public broadcasters, to compete effectively in current media markets.

Some governments have taken a proactive approach while others have not as they do not consider the transition to DTT a national priority. Thus, in these cases the transition is not supported by the necessary authorities and with the required initiatives. Due to this, countries in APAC have different digital penetration rates. According to Ovum, the 59% digital penetration rate in the region will increase to 88% by the end of 2020. Ovum forecasts that by 2020, eight markets will have 100% digital penetration – Australia, Hong Kong, Japan, Malaysia, New Zealand, Singapore, South Korea and Taiwan.

India and Thailand will have over 95% digital penetration.

Another obvious constraint to the transition is the lack of incentives and education for consumers. Low-income countries in the region will have further challenges in financing the transition – many households do not have the disposable income to purchase new digital equipment (STBs or digital converters). In this case, governments have to step in to finance the purchase of necessary digital equipment for households – however, some lack the funding to do so. Therefore, there is little incentive for broadcasters to go digital if their customers lack the necessary equipment to receive digital broadcasts.

[bctt tweet=”Low-income countries in the (APAC) region will have further challenges in financing the transition – many households do not have the disposable income to purchase new digital equipment – IABM Business Intelligence Report”]

Several countries have experienced challenges in the transition to digital broadcasting, some of which are reported below:

- IndiaThe initial deadline set by the Ministry of Information and Broadcasting was March 2015, and was due to be done in three phases. However, the deadline for the transition has been extended several times, largely due to consumers not having the necessary digital equipment, which meant that many households would be left without service. Currently, Doordarshan, the national public broadcaster, is expanding its DTT services; the company operates DTT services in 16 cities with the digitization of its terrestrial TV transmitters ongoing in 63 cities. Doordarshan is one of two divisions owned by Prasar Bharati, which has the monopoly on terrestrial broadcasting and claims to reach more than 90% of the Indian population. In the process of expanding DTT services, Doordarshan has opened discussions to involve private broadcasters and will spend Rs320 crore to achieve its targets by 2018

- IndonesiaThe transition to DTT was initiated in 2010, and due to be completed in 2018. However, due to challenges including numerous technical and legal barriers, the timeline to complete the transition has now been extended to March 2023. The existing 2002 Broadcasting Law is considered to be too outdated to accommodate the latest technological advancements, which has deterred investment. Some free- to-air television stations and broadcasters offer limited digital terrestrial television services in specific regions.

Currently, companies are limiting their investment until the law is revised to ensure business sustainability

Most countries in Asia-Pacific rely on the European DVB-T standard, although there are some exceptions. South Korea relies on the American ATSC. Japan, the Philippines and Sri Lanka rely on the Japanese ISDB-T. China also relies on its own standard, DMB-T. It is worth noting that some countries in this region have yet to decide which standard they will adopt.

Overall, the transition to digital broadcasting is a significant driver of broadcast and media technology spending in APAC. Broadcasters will continue to upgrade their infrastructures to allow for DTT broadcasting. It is an important opportunity for traditional suppliers such as transmitter vendors and system integrators.

Transition to HD

The transition to HD remains an important spending driver in Asia-Pacific, similar to other developing regions such as Africa. While some of the developed broadcast and media markets in the region have adopted HDTV, such as Australia and Japan, developing countries are still in the midst of transitioning to HD. The transition to digital broadcasting in developing countries, such as India and Indonesia, will see the offering of HD channels significantly increase as terrestrial spectrum is freed up.

As in the case of other developing regions, satellite broadcasting is important to the development of HD in APAC, as well as the progression of digital TV subscribers. Satellite service providers have turned to emerging regions to compensate for low growth in maturing markets such as North America and Europe; many satellite service providers have expanded their capacity in the region to allow for more extensive coverage.

[bctt tweet=”Satellite broadcasting is important to the development of HD in APAC, as well as the progression of digital TV subscribers – IABM Business Intelligence Report”]

In developed broadcast and media markets in the APAC region, such as Japan and Australia, HD is the mainstream broadcast- ing format. These markets are investing in higher resolution formats – Japan was the first country to broadcast in HD and is now focusing investments on 4K and 8K. Australia is seeing an increase in competition from OTT/ on-demand providers so investment is mostly focused on providing on-demand content delivery on various platforms for customers.

In China, the first HD channels were launched in 2006. The number of HD channels has been growing since then to reach over 40 channels delivered in 2015. This is a low number of channels compared to advanced broadcasting markets such as North America and Western Europe. Growth in HD channels in China is expected to continue over the next few years.

India is expected to see huge HD channel growth due to increased demand – many non-HD channels have plans to launch their HD versions. Tata Sky, a satellite broadcaster, has the largest share of HD channels (102), followed by Dish TV with 60 and Videocon d2h with 50. Major movie channels such as Star Movies, HBO, Zee Cinema and Sony Pix all have their own HD versions with a huge number of subscribers. Moreover, in 2017, new rules on the pricing of television channels has made HD channel viewing cheaper by around 70%.

The new rules will see a price cap of Rs19 on all channels; at present, channels are priced very high to encourage consumers to purchase channels in ‘packs’, so this will address the problem of consumers having to purchase bundles that include unwanted channels. This will make individual HD channels more accessible for consumers, which should drive growth.

Considering how large the populations some countries in APAC are – such as India and China, there is huge potential for HD channel growth. As the adoption of the most advanced compression standards increases, broadcasters in developing Asia-Pacific countries will look to add more HD channels to their portfolios.

[bctt tweet=”As the adoption of the most advanced compression standards increases, broadcasters in developing Asia-Pacific countries will look to add more HD channels to their portfolios – IABM Business Intelligence Report”]

Transition to New Viewing Experiences

The more developed broadcast and media markets in APAC, such as Japan and South Korea, have launched 4K/UHD initia- tives. There has also been investment in HDR, 8K and VR. There is a greater level of interest and investment in higher resolution formats in APAC compared to North America and Europe. There is significant interest in higher resolution in APAC, with large-scale projects opting for 4K/UHD, particularly in live production. Several broadcasters and media companies in the more developed markets in APAC are launching 4K/UHD initiatives in both sports and entertainment content production.

At the 2018 Winter Olympics in PyeongChang, South Korea produced and broadcast in 4K HDR for the first time. The collaboration between the Olympic Broadcasting Services (OBS) and Japanese broadcaster, NHK, enabled the content to be captured in 4K HDR with broadcasters and media companies deciding whether it would be broadcast to consumers in the higher resolution. NBC and Comcast provided 4K HDR coverage to consumers in the US with a 24-hour delay. More- over, 90 hours of 8K UHD content was captured in HDR with 5G live production available to spectators in special zones using 5G-ready mobile devices. Although some of the 2016 Summer Olympics in Rio de Janeiro provided 4K coverage, this was the first-time content was captured and broadcast in 4K HDR. The innovative production of the 2018 Winter Olympics also paved the way for the 2020 Summer Olympics in Tokyo – Japan’s NHK plans to implement 8K technology nationwide in time for the 2020 Summer Olympics.

Japan has always been at the forefront of broadcast technology development with Japanese public broadcaster, NHK, a major player in testing new broadcast technology. There are some Japanese operators that have launched 4K/UHD initiatives in 2016 and 2017, such as SKY Perfect JSAT and Hikari TV, and 4K UHD programming/ channels are expected to increase in Japan. NHK is set to launch an 8K satellite channel in December 2018.

The Japanese Ministry of Internal Affairs & Communications announced that by the end of 2018 the country will likely have between 19 and 22 4K channels on air. The Ministry anticipates that public broadcaster, NHK, will operate one 4KTV and one 8KTV channel, with the remaining channels operated by various commercial broadcasters (free-to-air and Pay-TV).

4K/ UHD is also big in South Korea’s broadcasting market – another 4K/UHD leader in the APAC region. The world’s first channel to be broadcast in 4K/UHD was the South Korean Pay-TV channel UMAX in April 2014 (HEVC was used for encoding the broadcast). UMAX is carried by most cable service providers in South Korea. KT Skylife, a satellite Pay-TV service provider, launched its 4K UHD offer to subscribers in June 2015. KT Skylife is focusing on growing its offering by establishing additional UHD channels and experimenting with 8K broadcasting.

[bctt tweet=”4K/ UHD is also big in South Korea’s broadcasting market – another 4K/UHD leader in the APAC region. The world’s first channel to be broadcast in 4K/UHD was the South Korean Pay-TV channel UMAX in April 2014 – IABM Business Intelligence Report”]

4K/UHD was first launched by Pay-TV operators, but South Korean public broadcasters have recently launched their own initiatives. In 2017, terrestrial UHD broadcasting began with Korean Broadcasting System (KBS), Munhwa Broadcasting System (MBS), Seoul Broadcasting System (SBS) and Educational Broadcasting System (EBS) launching their channels.

Nationwide UHD coverage in South Korea is expected by 2021 with a provisional date of 2027 as a target for HDTV stations to be switched off. In India, satellite Pay-TV operators, Tata Sky and Videocon d2h, started broadcasting selected matches of the ICC Cricket World Cup in 4K/UHD in 2015. Both operators also have a single 4K/UHD channel each. Airtel Digital TV followed with 4K/UHD broadcasting towards the end of 2015. Star India broadcast the first 4K Bollywood movie at the end of 2015 with Videocon d2h, with Tata Sky and Airtel Digital TV also showing the movie on their platforms.

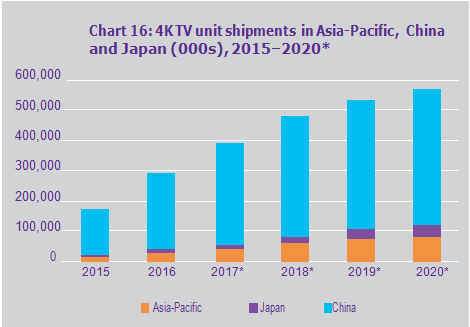

4K TV shipments are forecast to increase across APAC. China will continue to dominate the 4K TV market, with the 25m+ 4K TVs shipped in 2016 and set to almost double by 2020 to 44m. Accord- ing to IHS Markit, this trend is expected to spill over into sales of 8K TVs in China when they become available to purchase.

The rest of the APAC region is still in early stages of 4K/UHD development compared to the more developed broadcast and media markets. In the developing markets the primary focus is HDTV. However, early initiatives have been launched in some other countries – Vietnam Digital Television (VDT), a terrestrial broadcaster, launched a 4K/UHD channel in 2017, with a focus on producing more 4K/UHD content in 2018.

OTT and Multi-Platform Delivery

OTT and multi-platform delivery is on the rise in APAC although the challenges of low broadband penetration and poor broadband quality in developing markets hinders development. Many broadcasters and media companies in the region are addressing the changes in consumer viewing habits and the increased competitive threat from OTT platforms. The landscape of OTT varies across the region due to substantial differences in development between developed and emerging markets. Key factors that are driving the adoption of OTT are improving broadband connectivity, rising smartphone penetration, improving payment options, falling data tariff prices and rising per capita income. However, there are significant challenges that remain including piracy, limited credit card penetration, underdeveloped broadband infrastructure and lack of regional content.

[bctt tweet=”OTT and multi-platform delivery is on the rise in APAC although the challenges of low broadband penetration and poor broadband quality in developing markets hinders development – IABM Business Intelligence Report”]

There is a number of local and foreign VOD platforms available to consumers, some being standalone platforms while others are offered in combination with linear services. Many operators are addressing the challenge by offering bundles that combine Pay- TV, broadband and/ or the integration online video services to differentiate their services. OTT providers have partnered with telecom and Pay-TV operators to increase their subscriber base and overcome some of the challenges, such as billing. This also allows telecom and Pay-TV operators to strengthen their offerings with OTT services to retain and attract subscribers.

Consumers in APAC are increasingly watching content on mobile devices, similar to trends in other regions. Broadcasters and media companies need to ensure that they have the capabilities to distribute content beyond just TV screens. According to Ooyala, APAC leads the world in terms of video plays over mobile – 64.4% of video plays occurred on mobile devices in Q3 2017. In much of the region, mobile has become the primary viewing device as smartphones become more accessible and broadband quality improves.

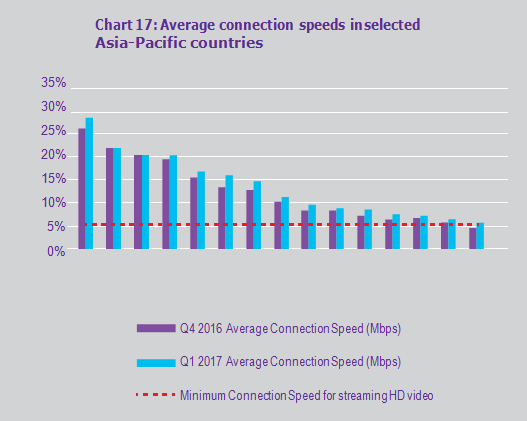

The proliferation of on-demand viewing is largely driven by the development of broadband penetration and quality in the region. However, there is a variation between countries, as shown in Chart 17. South Korea and Singapore have the fastest average connection speeds in the region, while China and India have the lowest. The affordability of broadband is also a challenge in some countries – for example, broadband is cheap in the Philippines for average income households whereas for low-income households it is not the same. Governments across the region are addressing the challenges with plans to develop broadband infrastructure and increase broadband accessibility for low-income households.

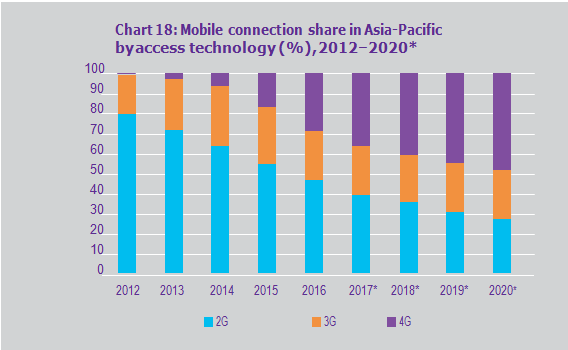

Mobile broadband is on the rise in APAC, as content consump- tion on mobile devices continues to grow. In many countries in the region, mobile broadband networks have overtaken fixed broadband as the main mode of internet access. This is driven largely by investment in 3G/ 4G – and in some cases 5G – the cheaper data tariffs and low-cost smartphones. According to eMarketer estimates, there were 1.33bn smartphone users in APAC in 2017, forecast to increase to 1.81bn in 2021. Moreover, according to GSMA Intelligence, 41% of mobile connections will be on 4G networks in 2018, with 23% on 3G and 36% on 2G. This trend is expected to continue as the availability of 4G LTE mobile broadband networks increases as a result of increased investment by mobile carriers and falling prices. The developed markets – Japan, South Korea and Australia – have high 4G penetration rates, with developing countries, such as India and Vietnam just catching up.

[bctt tweet=”There were 1.33bn smartphone users in APAC in 2017, forecast to increase to 1.81bn in 2021…41% of mobile connections will be on 4G networks in 2018, with 23% on 3G and 36% on 2G – IABM Business Intelligence Report”]

There are some APAC countries looking ahead to the launch of 5G networks. According to the China Academy of Information and Communication Technology government research arm, China is planning to invest around $411bn in 5G mobile net- works between 2020 and 2030. Total 5G subscribers in China are forecast to reach 588.3m by 2022, up from 31.9m in 2019. Japan is also expected to be an early adopter of 5G. Its three largest mobile network operators – SoftBank, NTT Docomo and KDDI – are planning to spend a combined $45.7bn with the aim of launching faster networks by 2020. These companies have already started 5G trials. The development of 5G will accelerate the adoption of OTT services.

Poor payment infrastructure is also a significant challenge, similar to other developing regions. Low credit card penetration, with the exception of some countries in the region, hinders the growth of OTT services. OTT providers must find ways to circumvent this problem with solutions such as SMS payments or gift cards. This is a major reason why OTT providers are partnering with telecom and Pay-TV operators. Iflix, an SVOD service provider based in Malaysia, has addressed payment issues with its partnership with CSG Systems International. CSG will use its Ascendon digital services platform to consolidate and manage a range of payment options for Iflix, making local payment options available to consumers – Iflix consumers can charge their transaction to their monthly mobile phone bill.

According to Digital TV Research, OTT revenues are set to triple in APAC from $8.27bn in 2016 to $24.4bn in 2022. China is expected to account for half the OTT revenues by 2022, with China and Japan together accounting for two-thirds of the region’s total by 2022. The OTT market in APAC is roughly split between SVOD and AVOD.

As emphasized earlier, local content is vital to the success of OTT services in APAC. The region represents a mix of different cultures and languages which makes content localization key for operators targeting more than one country. Consumer preferences being sided towards local programming is driving OTT providers to invest in producing local content to differentiate their services.

[bctt tweet=”Local content is vital to the success of OTT services in APAC…Consumer preferences being sided towards local programming is driving OTT providers to invest in producing local content to differentiate their services.- IABM Business Intelligence Report”]

Netflix first entered the APAC region in early 2015, going live in Australia and New Zealand – Netflix is the most popular streaming service in Australia. Following this, Netflix launched in Japan towards the end of 2015 before going live in the rest of APAC in 2016, with the exception of China and North Korea.

Netflix recognized early on that local content was the key to success in APAC, which is why when the company entered Japan, it embarked on a different strategy – Netflix offered a greater proportion of local TV shows and movies than subscribers receive in other countries. Usually Netflix offers 20% local-made programming; in Japan this was pushed to 40%. Moreover, Netflix entered a deal with telecom and internet giant SoftBank to offer its customers easy ways to pay for its Netflix subscription. Netflix has replicated this strategy across the whole region by entering agreements with local companies producing local content.

Amazon Prime Video has followed a similar strategy to Netflix in APAC, with local content a priority. Amazon entered the APAC region at the end of 2015 with its launch in Japan, offering its streaming service free to Prime customers. In 2016, Amazon launched its video services in Singapore, Malaysia, Taiwan, Hong Kong, Cambodia, Indonesia, Philippines, Thailand and Vietnam. In India, the streaming video service is available to Prime customers free of charge. India and Japan are the biggest retail markets for Amazon, with more than 70% of the content on its streaming service being local. Amazon intends to differentiate itself with its content and leverage its Prime service to attract subscribers.

Iflix is another major player in the region, first launching in Malaysia and the Philippines in mid-2015. Its services are available in 14 countries across APAC with over 5m subscribers in the Asian markets at the end of the first half of 2017.